Financial wellbeing is about feeling secure and in control of your money. It is knowing that you can pay the bills today, can deal with the unexpected, and are on track for a healthy financial future.

Healthy, happy employees bring huge benefits for their employers, helping organisations to perform better, be more creative, and have reduced turnover, sickness and absences.

Financial wellbeing is a key driver of workplace wellbeing, and money worries are a huge cause of stress for UK employees: they cause one in four to lose sleep, and 8 in 10 take these worries into the workplace, affecting their performance.

Most employers now recognise the link between financial wellbeing and productivity, with nearly 7 in 10 UK employers believing that staff performance is negatively affected when they are under financial pressure. And employers are also uniquely positioned to deliver money guidance at the times their employees most need help: when they start work, when they change jobs, when they become parents and when they retire.

What’s out there?

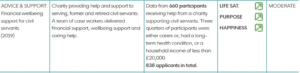

There have always been financial wellbeing activities as part of employment. Recently there has been a rapid increase in the number of financial wellbeing solutions. Less is known about ‘what works’ though, and employers need guidance about what they can deliver with confidence.

There is also a need for easy access to financial education and guidance, and there are a range of other options that employers can add on, such as:

- Access to regulated advice

- Financial products and services, such as Payroll Savings schemes

- Cost-reduction schemes (interest-free loans for travelcards or bicycles, discounted memberships etc)

- Low-cost loans, or salary advances to manage short term money emergencies

So, the case for improving workplace financial wellbeing is clear, and we have a dynamic marketplace offering a range of solutions. But although there is some promising theory and practice about how to design workplace interventions, we know very little about their impact on employees, or whether employers are getting any value from their investment in them.

What do we know?

Most of what we know about workplace financial wellbeing interventions is focused on some good principles for their design. The right combination of support is dependent on:

- Employee base, including number of employees, and their working pattern and location

- Levels of need across types of employee, acknowledging that age, gender and other factors affect the type of help people need, at different times

- What is feasible for the employer, or related organisations such as sector charitable organisations and professional bodies, to deliver

Positioning financial wellbeing within a wider organisational wellbeing programme is, according to the evidence, likely to be most effective for wellbeing and performance. It is important for employers to:

- Understand employees’ needs

This will provide insight about how to target different groups of employees, and identify the right elements in a package of support for their staff. Early engagement can also help to raise employees’ awareness about the forthcoming scheme, and their eventual buy-in to it.

- Explore the most appropriate provision

Once employers have gained a good idea about the needs of their staff, they can start to look at how a financial wellbeing programme might operate, for example:

- When and how to mix internal and external support

- Considering the most suitable mode of delivery for different employees

- How behavioural insights can help to encourage take up of the programme and embed learning

- Making use of ‘teachable moments’ to deliver help – as their employees start a new role, plan a family, or look at pension options.

The What Works Centre for Wellbeing has produced an evidence based model and action plan for organisations looking to embed their workplace wellbeing programmes.

What don’t we know yet?

We know very little about the impact that financial wellbeing programmes have on employee wellbeing. We don’t know what combinations of interventions work best, in different types and sizes of employer, and for different workforce compositions. We don’t know how employers can best target guidance to employees, using data they already hold and common points of interaction. We don’t know whether and how a wider range of behavioural science-informed interventions could be integrated into workplace programmes. There is much to learn and we would like to work with funders and employers to help us find out what works best.

Having said that, there is one area where we do have a promising and growing evidence base: payroll savings schemes, where an employer deducts the amount the employee wishes to save directly from wages via the payroll. At the Money and Pensions Service we have worked with Nest Insight, the Financial Inclusion Centre and others to understand how these schemes can work to overcome behavioural barriers to saving, and how they can best be promoted to and embedded within organisations. Again, evidence of impact is lacking, and it is important that implementation here is at an appropriate level – and further tested and evaluated so we can all have more confidence on its impact.

How to make sure interventions help employees and businesses

- Make the most of what we do know: use the compelling insight we have that makes the case for improving financial wellbeing at work; use the good practice we do know about, to think about employees’ needs and how they could be addressed before designing and/or buying a financial wellbeing programme.

- Build the evidence. Employers should build good quality evaluation into the financial wellbeing programmes they deliver – this will not only help them to continuously improve their programmes, but will fill the gaps in our understanding and contribute to wider learning about the impact of these programmes.

Funders and policymakers can encourage this by offering clear guidance and support about how best to evaluate schemes – and the Money and Pensions Service and What Works Wellbeing can help with this.

Watch the webinar

Why financial wellbeing matters at work